In an industry that's increasingly driven by innovation and efficiency, staying at the forefront of...

A Comprehensive Guide for Cabinetmakers Investing in CNC Machines

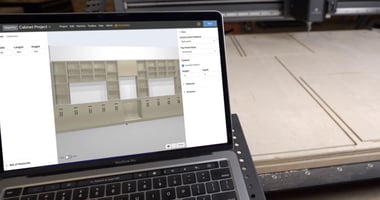

Investing in new technology, like CNC machines, can be a game-changer for cabinetmakers. CNC machines offer precision, efficiency, and the ability to create intricate designs that would be challenging, if not impossible, by hand. However, these machines represent a significant investment, and understanding your financing options is crucial.

Firstly, it's important to view the acquisition of a CNC machine as an investment in your business's future. With increased efficiency and quality, you can take on more complex projects, attract a wider range of clients, and ultimately improve your bottom line.

Now, let's explore some financing options:

-

Equipment Loans: This type of loan is specifically designed for purchasing business equipment. It usually covers up to 100% of the equipment cost, with repayment periods typically ranging from two to five years.

-

Leasing: Leasing a CNC machine can be a great option if you don't want to commit to purchasing outright. It allows you to use the latest technology with lower upfront costs and the flexibility to upgrade as newer models become available.

-

Line of Credit: A business line of credit can provide the flexibility to finance your CNC machine, allowing you to draw funds as needed and only pay interest on the amount used.

-

Equipment Financing Programs from Manufacturers: Some CNC machine manufacturers offer direct financing programs. These can often provide competitive rates and terms, so it's worth checking with your preferred manufacturer.

At Inventables, we've partnered with Geneva Capital to offer a tailored financing solution for your business. Through our relationship with Geneva Capital, you can apply for business financing directly, making the process of acquiring a CNC machine easier and more affordable than ever. To find out more and apply, visit this link: Inventables Financing with Geneva Capital

Remember, each financing option has its pros and cons, and what works best for your business will depend on your specific circumstances. Always seek advice from a financial advisor to help you make the most informed decision for your business.